Bankruptcy, dissolution and simmilar or anything that leads to them not conducting expeditions for longer than 1 year without visible progress being made counts as YES, regardless of name changes, acquisitions and such. The 1 year period has to start before market close.

People are also trading

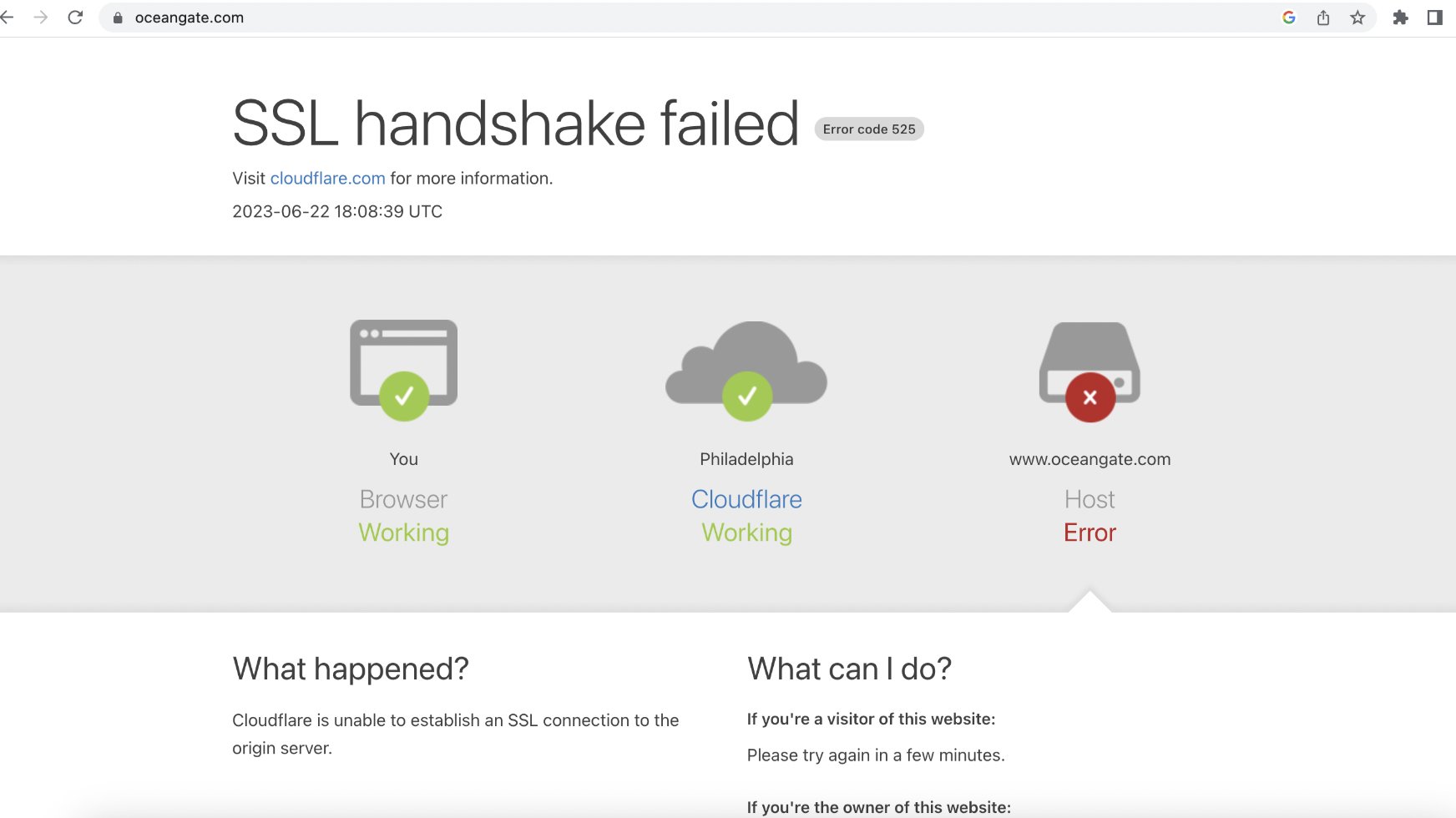

@CodeandSolder no recent news about financials or legal but its site has had "OceanGate Expeditions has suspended all exploration and commercial operations." for months now, how long until it counts for resolving as yes?

@kaleidofunk 1 year with no expeditions and no significant progress towards one as stated in the market description

@kaleidofunk continuous, has to start before market close, so current one is running since the catastrophe unless they started doing something significant that I'm not aware of.

Surprised this is still at 86%.

CEO killed by company equipment

Track record of ignoring safety concerns

Company murdered 100% of their FY2023 customers and like 10% of customers overall

Main revenue-generating asset destroyed

Can’t rebuild asset because design was flawed

Prior design marketed as “designed with NASA and Boeing” which was stretching the truth at best

0% chance NASA or Boeing does any business with Oceangate going forward

Reports that employee morale was low prior to accident

Likely exodus of most remaining employees

Nobody with decent engineering skills would go anywhere near this company

Company had cash-flow problems even before the accident (see news reports of the people who tried to get a refund on their deposit)

Videos of prior questionable judgment now surfacing, like when they let a passenger drive the sub and passenger immediately ran it into a rock 🤦♂️

Reports that Canadian government looking at filing criminal charges

Also still open questions about whether they knew the sub was failing on the dive, why they waited 6 hours to report it, and how often they lost comms on prior dives.

@stevez their financials don't make much sense to me in general, two years ago they apparently raised $19M to build two replacements for Titan: https://www.geekwire.com/2020/oceangate-raises-18m-build-bigger-submersible-fleet-get-set-titanic-trips/

They also most likely still have operational Antipodes and Cyclops 1 which should be possible to generate profit with, theoretically

@CodeandSolder Interesting, I hadn’t realized they raised that much money. I wonder who the investors were.

FWIW my probabilities on various outcomes are as follows:

60% chance they’re out of money and simply go bankrupt (or their money is tied up in worthless assets like more carbon-fiber subs). Certainly they were behaving this way: not issuing refunds, desperate to run trips, cutting costs at every opportunity, etc.

32% there is a pile of money but civil or criminal litigation wipes it out (80% conditional on still having any operating cash) since liability waivers only cover ordinary negligence.

6% chance they have money, manage to survive lawsuits, and restructure but still go bankrupt due to softening demand since they’ve shown these trips can’t be run safely at this price point.

2% chance they restructure somehow and keep running trips. Maybe the carbon fiber hull design is OK in shallower depths and they are able to run more frequent trips for less money… or something.

@stevez I do think there is something odd going on, on face value 18M is 2x the budget of Deepsea Challenger and should approach the cost of doing this thing correctly, which seemed to be the plan when it was announced.

As for how it ends I roughly agree, ~80% on running out of assets soon, ~10% on voluntary dissolution or sale because why prolong the inevitable, ~10% on drastic staff reduction and running shallow tours and other projects using the two metal subs they still own as they did pre-Titan at least until 2026

@stevez a theory that seems somewhat likely is that the deal was contingent on interest in the technology from oil drilling companies, as that was the initial target market, and so it fell through, coinciding with abandonment of that direction around the same time. That would explain the desperation to keep operating despite safety concerns, fueled by 50 people on the payroll and no access to capital necessary to do it right-ish