*citation needed

Tax needs to impact at least 2 people and be written in a way that it could impact anyone

Net worth requirements are ok

Something which targets an individual does not count

People are also trading

That's not what I understand the proposed policy to be.

Changing the current death policy to no longer include a cost-basis step up wouldn't count.

Changes to death triggering a CGT event shouldn't count either, but I'm open to other views. Those assets are changing hands and there are already some forms of estate tax in the US which are essentially, "a death tax on unrealized gains".

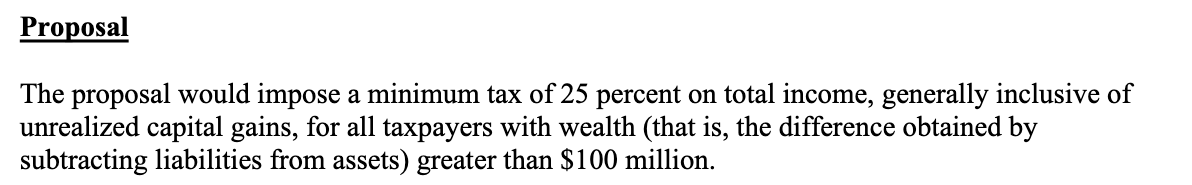

The new policy as outlined was something like, people with assets over $100m have their assets "washed" annually, triggering a CGT event, and tax would be payable at a minimum of 25% of total income (irrespective of the realized portion).

edit: also TY eliza for @ing me! I saw this in my mentions but missed the first comment

Okay, so just to clarify the spirit of the market is intended to be about the section:

IMPOSE A MINIMUM INCOME TAX ON THE WEALTHIEST TAXPAYERS

from this document:

https://home.treasury.gov/system/files/131/General-Explanations-FY2025.pdf

And mainly about the part here:

But ALSO including any other income taxes on capital gains that function in a similar way.

---

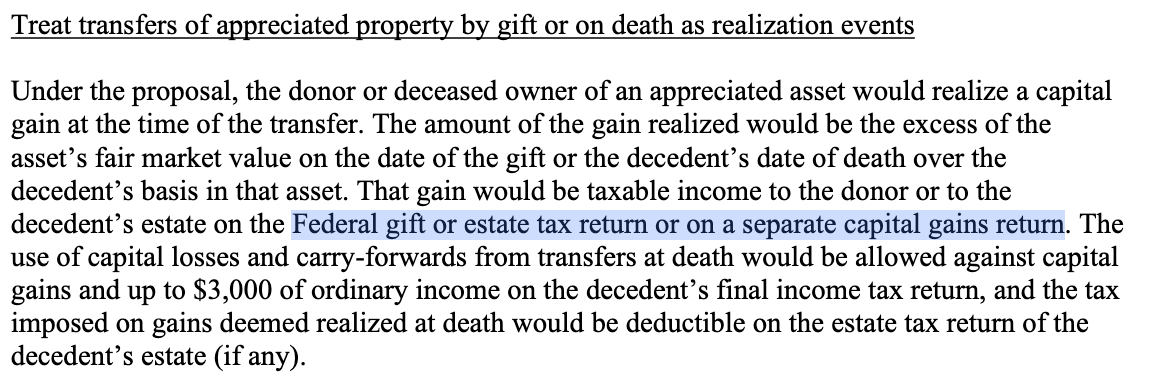

And the spirit of the market is to NOT include any tax like this example described under

REFORM THE TAXATION OF CAPITAL INCOME

which is listed as a gift or estate tax, even if that tax is a new tax on unrealized gains.

Is that right, or can you point out what parts I'm not quite catching correctly? I think we can improve the description or title of this market, especially if it is specifically about "income taxes" rather than "gift taxes" and "estate taxes"?

Hmm I see, thank you! You are right that it can be improved, and I should have mentioned income tax. That oversight totally changes the way I intended this market to be seen. I wanted to include any/all taxes on unrealized retained assets - not received assets (either via estate, gift, or w/e).

I've been thinking about this for a bit but I'm not sure what the best approach is. Based on the wording, it is reasonable to expect received assets to be included, and so I probably should include them.

If you think it makes sense, I'll include any new taxes which broadly introduce ways to tax unrealized gains. Meaning, any new taxes or the introduction of a new realization event where tax is payable on retained or received assets without the underlying asset being sold.

I'll then make a new market which specifies exclusions for new taxes or realization events on transfer