Clarification:

Market resolves if TSLA reaches >$690 ($690.01+) at any point before 8pm EST on 10/10 2025 - this includes After Market but not Overnight trading.

For After Market trading information: After-Hours Trading: How It Works, Advantages, Risks, Example (investopedia.com)

People are also trading

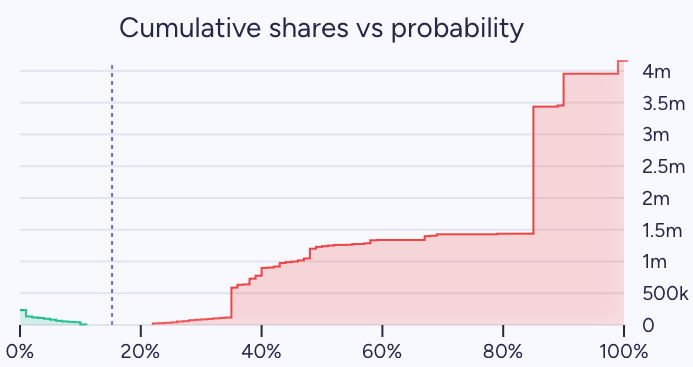

I like how it’s decreasing as the stock price increases lol

I wonder what's up with this. I mean, yes obviously, @MolbyDick (aka TSLABull) is bullish on TSLA, but it'd be way more cost effective to use limit orders.

My pet theory is that the motivation here isn't to win mana. Crazy thought, I know, but maybe he just wants to see the % be higher, no matter how fleeting? It's not enough to punch the air, you've got to feel an impact.

On a separate thought, if Manifold's loan system actually cared about bad loans, there would be all sorts of red flags here. It's using his mana in this market (and highly correlated markets) as collateral, but that collateral is clearly going to go to zero. Likely, he'll abandon this account with a large negative balance, and manifold will take a "loss". That's not something that concerns me, it's just a little meta prediction :)

@DanHomerick you’re almost on the right track.

I’ve lost 6M mana (when I had bought a bunch)

New goal is to get back to over 6M but without paying for it, just getting crazy markets like this, right ;)

@MolbyDick and yes I’ve been told to use limit orders since I made an account here.

I am just not going to and that’s that

On a separate thought, if Manifold's loan system actually cared about bad loans, there would be all sorts of red flags here. It's using his mana in this market (and highly correlated markets) as collateral, but that collateral is clearly going to go to zero. Likely, he'll abandon this account with a large negative balance, and manifold will take a "loss". That's not something that concerns me, it's just a little meta prediction :)

In general, this is clearly true—Manifold's protections on giving leverage to risky portfolios is minimal. The only real checks are (1) loans given on min of current value and spend, (2) per-market loans capped at 5% of your total net worth, & (3) an extremely high overall leverage cap that few users reach. As risk reductions go, those are extremely light, Manifold effectively offers almost anyone free leverage (& when (2) was added, people did and still complain that it was too restrictive, although I think it's already far too lenient).

That being said, I don't think @MolbyDick has actually taken any daily loans on his position in this market. So there's no need to worry about the loan system in this particular case. He's basically just spending mana that he purchased himself.

@MolbyDick let’s just say the buying opportunities will continue to get better and better as time passes