The largest exchange traded fund (ETF) in the world is the SPDR S&P 500 Trust ETF. The SPDR launched in 1993 and is tracks the top 500 publicly-traded companies in the United States (i.e. the S&P 500). State Street Corporation, which manages SPDR, has also manages industry ETFs.

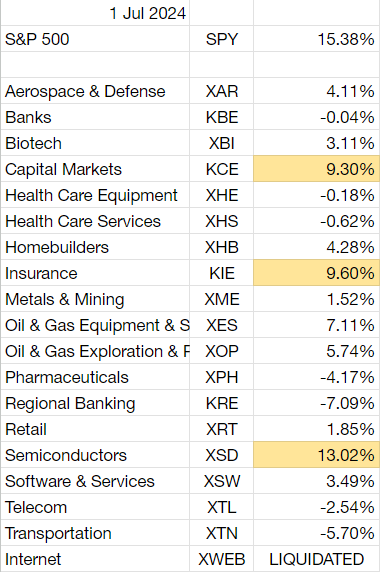

Which of these industry ETFs will outperform the S&P 500 in 2024?

In 2023, six industry ETFs grew more than the S&P 500 (itself growing 24.81%), those being:

Capital Markets (28.3%)

Homebuilders (56.49%)

Internet (42.02%)

Semiconductors (36.35%)

Software & Services (38.3%)

Transportation (24.82%)

This question resolves by comparing the YTD percentage growth of each fund at the end of December 2024 (e.g. as recorded on Google Finance) and resolving YES to the funds that grew by a percentage that is greater than the SPDR S&P 500 Trust's growth for the year (or if SPDR's growth was negative, then whichever ones lost less).

See also:

Yes. It will resolve NO when I close this market.