Attention: read below:

The world installed around 510 GW of photovoltaic panels in 2023.

The installations of photovoltaics globally grew historically at 26% compound rate. Wikipedia

However the growth from 2022 to 2023 was around 50%: Guardian

This is what a 26% compound growth looks like:

2024: 642.6 GW

2025: 809.68 GW

2026: 1020.19 GW

2027: 1285.44 GW

2028: 1619.66 GW

2029: 2040.77 GW

2030: 2571.37 GW

This is what a 50% compound growth looks like:

2024: 765 GW

2025: 1147.5 GW

2026: 1721.25 GW

2027: 2581.88 GW

2028: 3872.81 GW

2029: 5809.22 GW

2030: 8713.83 GW

EDIT:

I realized that the Guardian article that I quoted did not report solar panels installations but total renewable energy additions. I am really sorry of the confusion and the impact it has on the forecasts written above.

These are the latest data that I found:

Solar panel installations in 2023: 444 GW source (Not 510 as written above)

Solar panel installations in 2022: 252 GW source

This represents a YoY growth of around 76% (not 50% as quoted above)

These appear to me as the most accurate and recent data, even if there are small differences across various sources.

For the purpose of this market, the question remains unchanged even if the data used to reach those figures is inaccurate.

People are also trading

https://www.pv-magazine.com/2025/04/07/chinas-battery-storage-capacity-doubles-in-2024/

China's batteries are coming to the rescue to keep the trend going

Starting off on the wrong foot.

We now need 56% each year to catch up on 8713 and 27.5% for 2571.

BNEF prediction are going the other way too.

@figo I'm impressed that you're voting "no" when in the recent years we've been well above the historic average of 26% yearly increase.

@figo oh, yeah, and Bloomberg's prediction underestimated the actual figure for 2024. Just as expected.

Wow, this video shows that the official figures may largely underestimating the amount of solar modules installed in developing countries

Guess what?

Four months into 2024, China Securities has revised upwards their forecast for solar installations. They are still far from my own forecast, but I'd guess they'd be revised a few more times by the end of the year:

Anyone has comments on this? It sounds absurd: the solar projects waiting to be connected to the grid are over 10x the current total US solar capacity. Am I missing something?

@SimoneRomeo getting interconnect approval can take a long time, so developers will apply for a lot of grids at once.

@JoshYou yes, exactly. There are currently around 2600 GW of generation and storage capacity waiting to be interconnected to the US grid alone. It's crazy that this (mostly buroucracy) is the major problem blocking us from a sustainable future. Not the costs electric power generation.

Very interesting article here.

Key takeaways:

Major manufacturers have already built about 783GW of annual production capacity and we might hit the IEA’s 2030 installation target this year

Demand growth is exponential, tempting manufacturers to stake out territory with little regard for profit

The outcome of all that competitive bloodletting is typically a more concentrated market where smaller players go out of business

It’s a lot harder to connect a solar panel than it is to make one

Read more at: https://www.deccanherald.com/opinion/solar-success-is-a-curse-for-chinas-manufacturers-2932418

So, supply is growing exponentially, demand is growing exponentially, but bottlenecks risk to prevent actual installations. Will installations overcome these bottlenecks and also grow exponentially?

@SimoneRomeo Yes, I think the problem is shifting from manufacturing which can still scale well (growth in capacity, increase in performance) and installation where somethings get incrementally harder (scarcer land, total amount of new buildings per year, lower capture rate...). I expect more news like (cancellation of a production facility) this this year and next.

I stand by my predictions (which to be fair is still more or less exponential, just not at a breakneck speed like 26+%).

PS: I love this market, both the real one and the manifold one, can't wait!

@figo i mean, besides the apocalyptic titles, the sources that you cite offer a very diverse overview on the Chinese ecosystem. Some companies are halting projects, some companies are starting projects, not sure what to make out of this. Particularly, considering that we have already manufactured over 783gw of panels. This number is mind boggling and it testifies that the bottleneck is definitely not manufacturing.

Here's a nice new read of the current global PV situation. Crazy times, let's see what's coming ahead

BloombergNEF sees it at 880GW in 2030, they can be wrong but 3x wrong seems hard, 10x wrong... you'd have to know something they don't https://www.pv-magazine.com/2024/02/20/bloombergnef-says-global-pv-installations-could-hit-574-gw-this-year/

@figo I think predictions of solar panels installations are laughable.

Check this picture showing the growth of renewables against predictions by the World Energy Agency. I don't have more recent predictions, but it basically shows that WEO kept getting wrong predictions year after year, and still keeps underestimating the figures. I don't know how they can be so badly inaccurate. Not sure if they based them on linear growth instead of exponential growth or they simply throw in random numbers. According to Bloomberg solar panel installations will grow around 100 GW more in 2024 than in 2023. I think it's laughable counting that Chinese installations alone topped 200 GW last year and they are growing over 100%. Feel free to bet against it.

@SimoneRomeo Yes but the graph you show dates from an era where there was no cannibalization. In many places, every new install produces when prices are close to zero. You have to account for this for any future looking scenario. Feel free to draw a straight line on growth but the world is completely different now. And by the way 1tw is huge by any standard.

@figo yes, I agree that grid challenges are the major obstacle in the growth of renewables (together with whether china can sustain such an impressive investment growth). We cannot be sure about the future, but I still believe that Bloomberg predictions largely underestimate the growth potential particularly in the very next years (the further the future, the more unpredictable).

Let me give you a couple of reasons to be positive anyway:

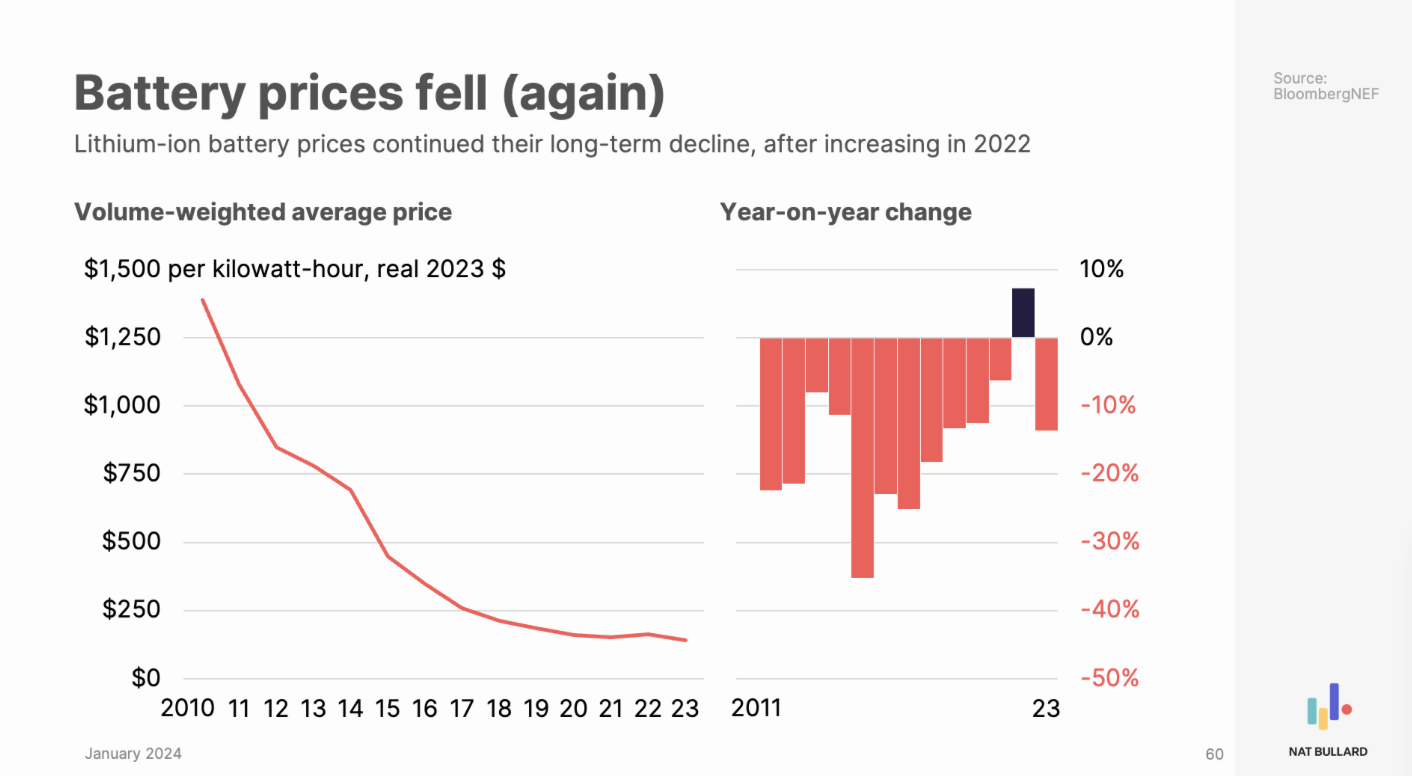

Battery costs are dropping A LOT. Around 90% in ten years! Unfortunately I couldn't find reliable data that shows how much battery installations is growing or how much the cost of battery + solar panels is, but I'd guess it's soon going to be cheaper than other energy sources.

Countries are starting to experiment with vehicle to grid solutions to use EVs as battery in case of need. China is a country already full of EVs, they just have to figure things out and then they'll be able to recharge EVs in the day and use their batteries in the night.

Finally, there's a more emotional reason: I wouldn't bet against human ingenuity - and particularly china's lol

Solar panels are now the cheapest energy source. Grid challenges are just another engineering challenge to overcome like there were many before and we've always been able to solve them. As long as there's a way to get cheap energy, we'll find a way to capitalize on it.

@SimoneRomeo I guess my bets are emotional hedges ;)

The crazy growth from the past years (and to some extent the years to come) came from the fact that the cost of electricity during sunny hours was coming down at a fast clip. Now that it's hit rock bottom, the growth will have to come from the combination of PV+battery (and transmission lines) which definitely has room to grow but starts from much lower.

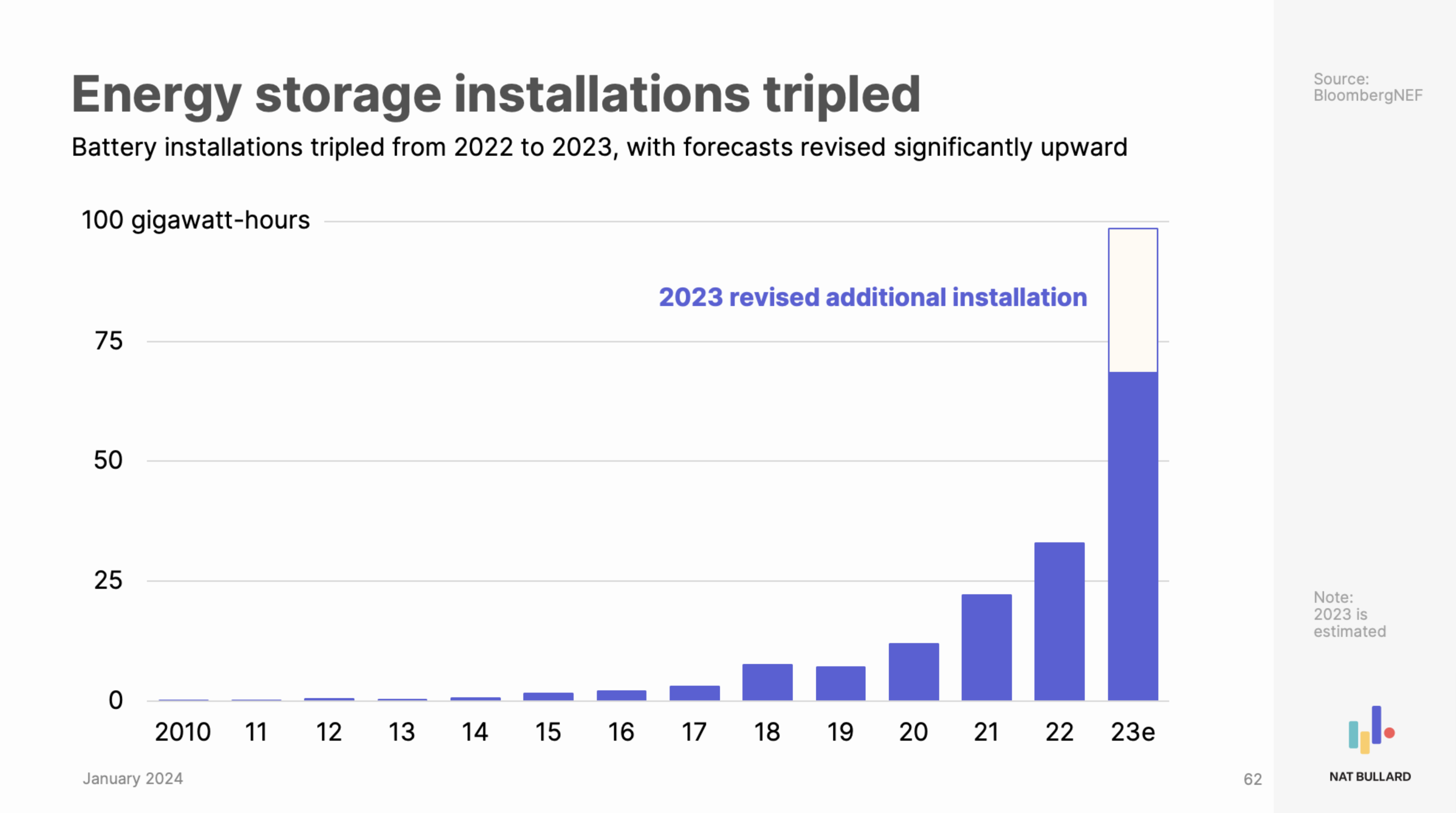

Here are Nat Bullard's slides on battery install and battery prices, pretty nice looking indeed.

I would bet we land greater than BNEF's 880GW in 2030 at 80%, but greater than 2500 is another level.

@figo wow! 300% Y2Y growth. I'm not familiar about the convertion GWh to GW, though. Anyway, if that trend of battery installations continue, it's difficult to think that any renewable milestone won't be achieved. Btw, you are skeptical that the exponential growth in solar panels installations continues. In order to stop being skeptical how much solar panels should we install in 2026 to show you that we are well on track to achieve the bull scenario?

@SimoneRomeo I'll buy a few more years of exponential growth at or below 26%. Happy to bet 33% on 2026 PV install at 1 TW (slightly below the 26% compound rate).

If you charge up 1GWh when it's sunny with abundant PV during the day and hope to cover 4 hours of dark/cloudy, then you'll get 250MW continuously. 4hr seems to be a customary benchmark (eg Australia) but you'd need much more in winter and much less in summer of course.

@figo how much should it increase to make you confident we are on a good track to keep installing solar panels at over 50% compound rate?

@SimoneRomeo I'd say, if we reach 2.5TW in 2026 (70% for 3 years), 8.7TW would be in sight (26% for 4 years).

@figo here you go. With the updated figure of 2023 solar installations 2.5 TW is 80% compound growth. Quite unluckily. I'll be yes once the probility goes low enough 😂😂

@SimoneRomeo haha, I bet 15% (which happens to be 36 today), happy to bet more to keep the price there when it moves. I just have 169M on hand but daily loans will do the trick

I just found another picture that can build our confidence in official forecasters' capabilities to understand the exponential trends that impact the deployment of renewables

@SimoneRomeo My thinking goes:

exponentials do taper down as not everything scales well (starting with available space and resources and most imminently the value of incremental mwh during sunny days (or even summer days with few hours of storage)) but it's hard to know when

26% exponential is already pretty exponential to me, for however long