CASE BACKGROUND:

In the early 2010s, I spent most of my earnings purchasing hundreds of bitcoins. I eventually deposited them at BlockFi, Genesis, Celsius, Voyager, FTX, and related companies. These companies were all scams, with most CEOs, such as SBF, Alex Mashinsky, and Barry Silbert either convicted, on trial, or under investigation.

After the companies failed, I decided to exit the cryptocurrency industry by selling the remaining coins I had in my possession as well as the bankruptcy claims for a large loss.

The first deposit (see https://restructuring.ra.kroll.com/genesis/, docket #50) from these sales was sent to my Wells Fargo accounts in February 2023.

When the initial million dollars arrived at the account, Gail Macker Carlino of Seashore Wealth Management (https://seashorewm.com), a Wells Fargo associate, told me that Wells Fargo was investigating my cryptocurrency involvement.

On March 12, 2023, she notified me that Wells Fargo closed 13 accounts owned by me, my brother, my businesses, my brother's business, my friends' business, and four credit card accounts.

Wells Fargo attempted to charge additional cancellation fees to me which I negotiated successfully to get dismissed.

One of the credit card accounts contained hundreds of dollars of Active Cash rewards points which had been earned through a promotional program they had advertised and which was the only reason I signed up for that card.

Wells Fargo seized the rewards points, claiming that when an account is closed for any reason, the rewards points are forfeit.

I paid the balance on the card for the valid purchases - except for the value of the rewards points - and notified Wells Fargo the remaining debt was invalid.

Wells Fargo charged off the debt and reported to credit agencies, dropping my credit score from approximately 780 to approximately 615.

I sent multiple demand letters to Wells Fargo offering a settlement and they declined.

See previous discussion: /SteveSokolowski/will-wells-fargo-sue-me

CAUSES OF ACTION:

Damages amount: $4,839.30 - the difference between 15 months of 22.24% APR and 0% APR, because I could not be approved to roll over this debt to a 0% APR card. I would have been approved if Wells Fargo had not reduced my credit score. Additionally requested $2,500 in damages in case primary damages are reduced - a conservative machine learning engineer salary of $125/hr for 20 hours of labor. Requested jurisdictional maximum of $12,000.

There are multiple causes of action listed, so that damages can still be awarded even if the judge finds one or two theories invalid:

False advertising: the Pennsylvania Unfair Trade Practices and Consumer Protection Law provides for treble damages. Wells Fargo's advertising at https://creditcards.wellsfargo.com/active-cash-credit-card, which I relied upon, does not mention in a prominent position that the company may forfeit rewards unilaterally.

Negligent credit reporting: the Fair Credit Reporting Act (FCRA, 15 U.S.C. § 1681s-2) provides for penalties in the case that a person reports an inaccurate debt. The debt for the rewards points value was not valid and should not have been reported.

Unconscionable contract: by common law, this contract shocks the conscience. It is fundamentally unfair for a contract to be able to be ended by one side. The fact that many other banks engage in similar credit card contracts, leading to a lack of consumer choice and prohibiting me from selecting another bank, supports this argument.

OTHER NOTES:

I will not sign any settlement which contains a non-disparagement clause.

The mess I find myself in while attempting to turn the page out of cryptocurrencies (and an unrelated fraud case) has resulted in a 100% winrate so far in small claims cases mostly dealing with account freezes; I received awards against Angi, the City of Tallahassee, Coinbase, and Block Inc.

There is a mandatory arbitration clause which still allows litigation in small claims court, which is why I pursued this venue.

Unlike the previous market, now that litigation has commenced I will only post information available to the public (such as court orders) as updates; I will not discuss legal strategy or reveal any communications with Wells Fargo.

In my experience, small claims cases like this are usually settled within two months, or by October 2024.

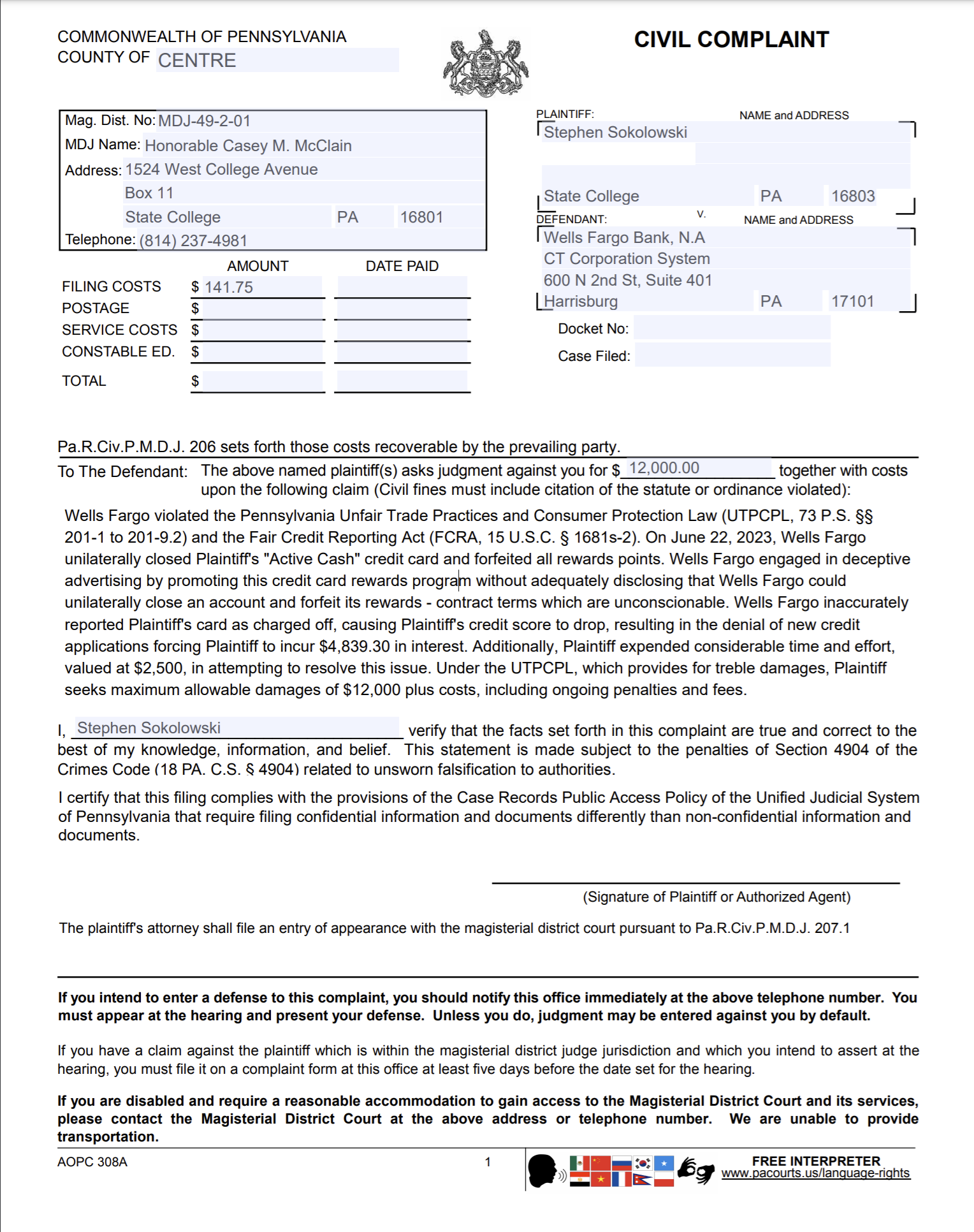

CASE FILING:

RESOLUTION:

The market will resolve to YES if:

A judge awards a non-trivial amount to me for any reason

The judge orders the credit file expunged of Wells Fargo's reports

A settlement of a non-trivial amount is reached, even if the settlement amount is bound by a non-disclosure agreement.

The market will resolve to NO if:

The case is dismissed with prejudice

Litigation permanently terminates without an award or settlement

I die and the executor of my estate chooses not to continue the case

UPDATES:

2024-08-29: Pennsylvania apparently has a "tiered" system for court fees. The previous case was rejected because I paid the same amount as it cost to sue Coinbase. This case is requesting larger damages, and the filing was rejected. I mailed a new form that is identical to the old one, with the amount changed to be around $210 instead, along with their rejection note and requested for it to be refiled. This is expected to cause a 7 day delay but has no impact on the case's disposition.

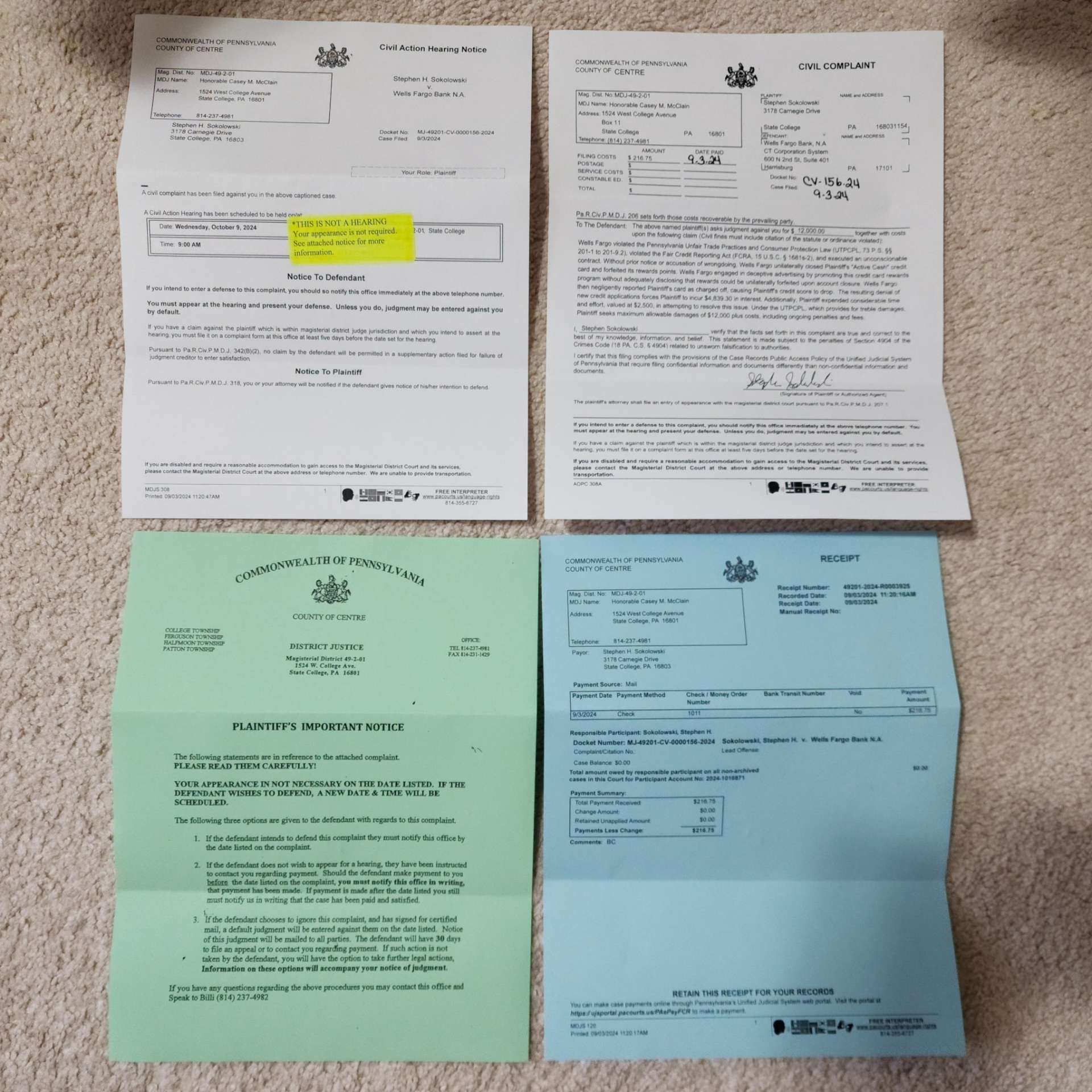

2024-09-06:

These papers are self-explanatory and show the hearing dates.

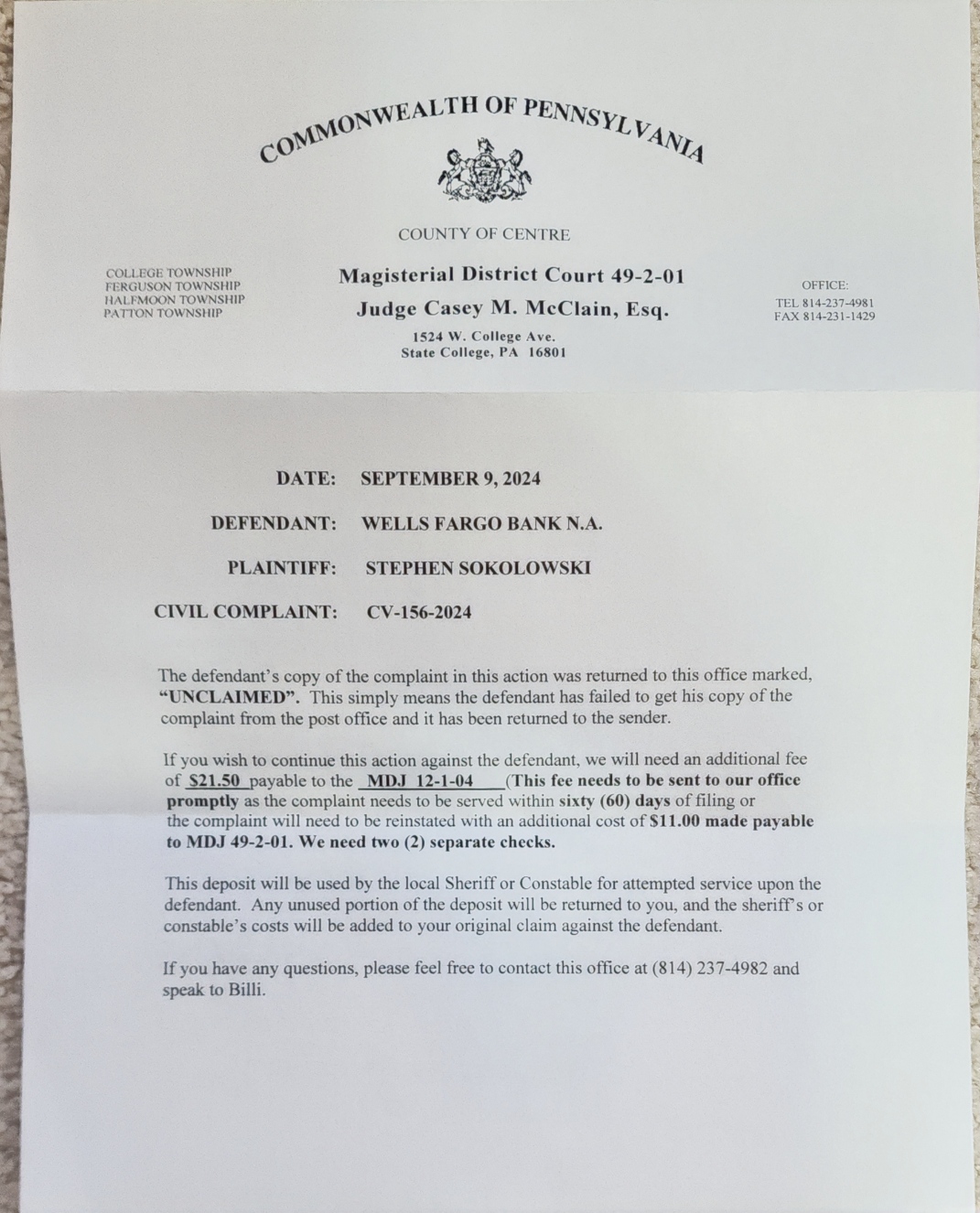

2024-09-12:

This has not happened in any of the five previous cases. I will pay the fee and ask the sheriff to serve them in person.

Related questions

@KevinBlaw The location is one of those virtual offices. It's the same location where Coinbase had their virtual office. The law requires these companies to have a presence in each state. I don't know exactly how these companies work, but I think there's just one person at that location who processes mail for all the companies registered there.

In the case that nobody accepts service there, I'll refile the case and serve them at their headquarters or at whatever address is correct.

I got out of my "No" position because I'm worried about the correct resolution here. As I understand the situation, Wells Fargo can ignore this case, and then file an appeal for the cost of under $200. If that happens, you are going to resolve this case YES? Or are you sticking with saying that the "final outcome of the case" being dispositive?

@FrederickNorris If they file an appeal, then I'll defend the appeal. The final outcome will be dispositive.

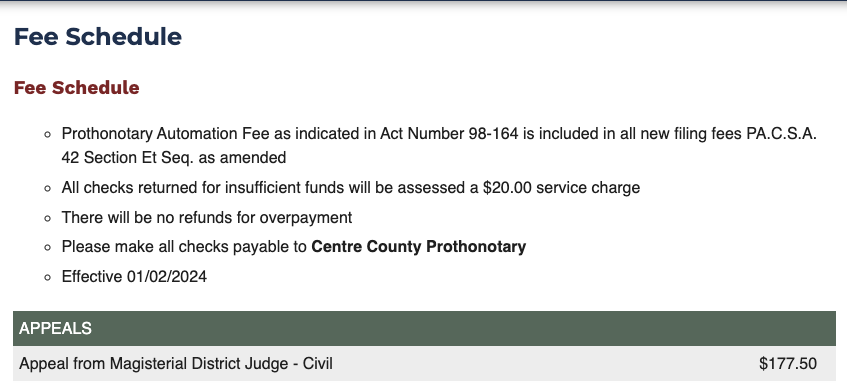

Small claims court in Pennsylvania does not allow for appeals. Instead, a party can request a trial in the "normal" court at their own expense if they disapprove of the small claims process. This is not an appeal because a judgment was never considered binding, and would not affect the market's resolution.

Why does this form exist if the small claims court doesn't allow for appeals? It clearly does.

If an appeal is filed, there is zero chance of your getting money from this.

@benjaminIkuta No, it wouldn't make sense. Paying on this kind of thing is encouraging more of it. This is just part of the cost of doing business for big companies.

@benjaminIkuta The fact that you think they might do it is exactly why they don't. If you have data to back up that non-lawyer lawsuits generate money, I'd love to see it.

@FrederickNorris review OP's other comments, he said he's gotten other settlements previously

@benjaminIkuta Other settlements from Wells Fargo? If he had sued for $39 which is what the case seems worth on its best day, maybe they would offer something. That he asked for $12k shows he’s not a serious person and not worth the breath it would take to explain the $39 settlement offer they might otherwise make.