Welcome to The All Memeing Bank!

I am currently in the situation of having more balance than I can find good trading opportunities to bet it in. Therefore, I am in search of users on this site who are in the opposite situation of wanting to take on loans because they find more good trading opportunities than they have balance to invest in.

If you would like a loan, please leave a comment, and I will hopefully respond within a day or two. Initially, I may only offer much smaller loans than others (e.g. 100 mana) to build up lender trust, but I'm usually willing to take a lower interest rate, and the loan size offered may significantly increase as trust improves.

I will use this description as a publicly visible ledger of all past and active loans. At the end of the year I will use this ledger to determine market resolution.

It's possible I'm making a bunch of rookie mistakes given that I've never academically studied finance and I'm pretty much deducing the principles from off the top of my head and from depictions in fictional media, but this is my current train of thought regarding loan interest rates:

Like haggling for a purchase in a street market, as the lender I want the interest rate to be higher and the borrower wants it to be lower. For there to be a possible deal we hopefully have an overlapping range between the worst deals we are each willing to accept (the lowest interest I'll accept vs the highest interest they'll accept). The default situation for purely self-interested agents would be us both trying to convince the other that our limit is stricter than it actually is within that overlap, but if we have a degree of cooperative altruism then we can agree to be transparent and set it at the midpoint of the overlap.

The lowest interest I should be willing to accept is one that leads to expected profit just above what I would otherwise get (currently zero because it's just sitting in my balance, but possibly much more in the future if demand outpaces supply leading to competition from other borrowers), via the interest in cases where it is paid back more than cancelling out losses in cases where it isn't. The probability of payback can be roughly guessed by long term consistency and rate of positive profit growth, as well as explicit track record of paying back loans, good market resolution honesty ratings, and word of mouth from other trusted users. E.g. if I think there's only 25% probability that Tumbles will be able to pay me back by winning their recent big bets or getting bailed out again then the minimum interest rate should probably be about 300%.

Similarly, the highest interest rate it makes sense for the borrower to accept would also give endpoint profit just above what they would otherwise get (if I have a monopoly then zero, but again possibly much more if there's competition from other lenders), via the expected trading profits more than cancelling out the interest. The expected trading profits growth rate per loaned amount might be possible to estimate from their profit and investment graphs.

Train of thought regarding loan sizes and due dates currently in progress.

Active loans:

Date and time: 2025-04-14 17:00 BST (UTC+1)

Recipient: Robin ( @Robincvgr )

Amount lent: 100 mana

Interest rate: 3%

Amount owed: 103 mana

Due date and time: 1 month, 2025-05-14 17:00 BST (UTC+1)Date and time: 2025-04-15 15:43 BST (UTC+1)

Recipient: bagelfan ( @bagelfan )

Amount lent: 150 mana

Interest rate: 3%

Amount owed: 154.5 ~ 155 mana

Due date and time: 1 month, 2025-05-15 15:43 BST (UTC+1)Date and time: 2025-04-15 17:10 BST (UTC+1)

Recipient: kbot ( @kbot )

Amount lent: 100 mana

Interest rate: 4%

Amount owed: 104 mana

Due date and time: 1 month, 2025-05-15 17:10 BST (UTC+1)Date and time: 2025-04-16 14:08 BST (UTC+1)

Recipient: Evan ( @evan )

Amount lent: 100 mana

Interest rate: 4%

Amount owed: 104 mana

Due date and time: 1 month, 2025-05-16 14:08 BST (UTC+1)Date and time: 2025-04-17 13:35 BST (UTC+1)

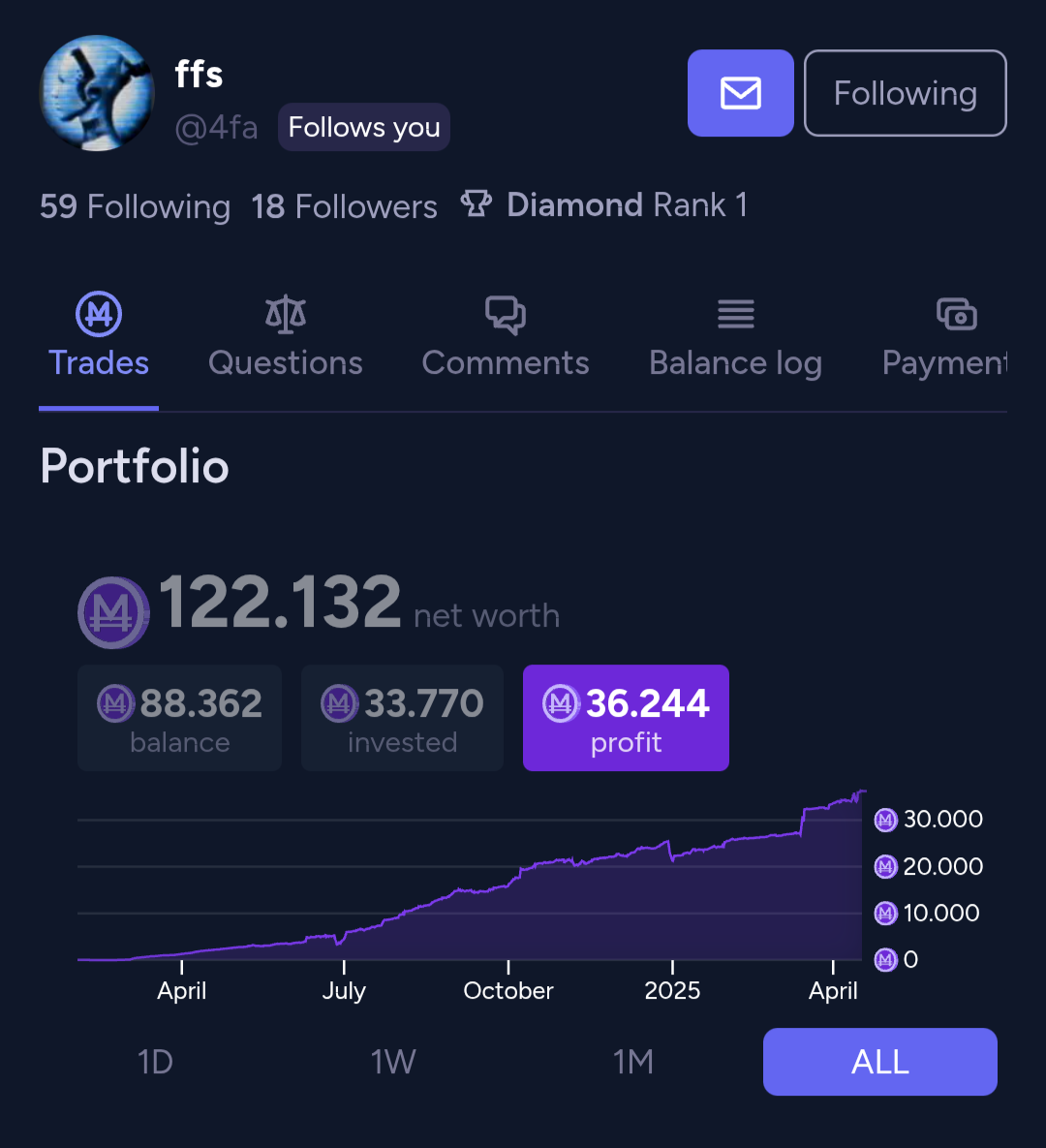

Recipient: ffs ( @4fa )

Amount lent: 100 mana

Interest rate: 4%

Amount owed: 104 mana

Due date and time: 1 month, 2025-05-17 13:35 BST (UTC+1)

Past loans:

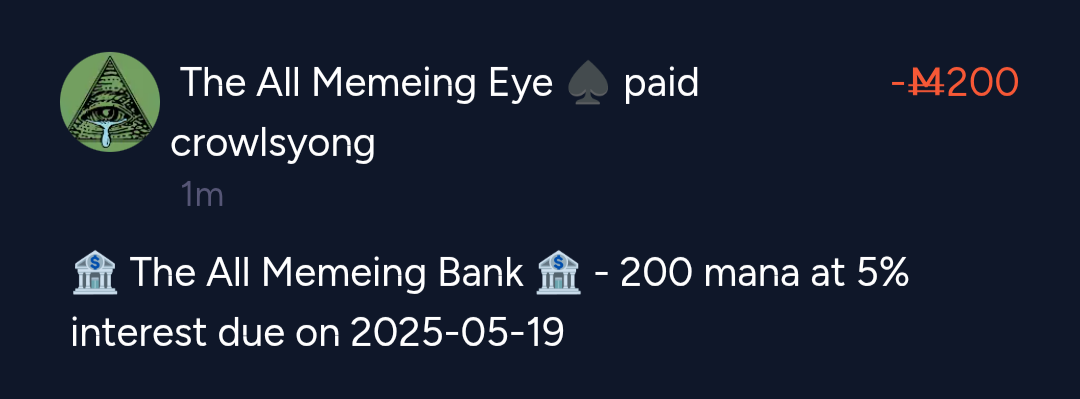

Date and time: 2025-04-19 13:06 BST (UTC+1)

Recipient: crowlsyong ( @crowlsyong )

Amount lent: 200 mana

Interest rate: 5%

Amount owed: 210 mana

Due date and time: 1 month, 2025-05-19 13:06 BST (UTC+1)Payback date and time: 2025-04-23 21:43 BST (UTC+1)

People are also trading

I'd be interested in learning what loans I would qualify for. However, any loan less than Ṁ1,000 isn't worth getting out of bed for (for me).

I will sometimes bet to a near-Ṁ0 balance if I see a surefire bet, but I like to have some reserves in the tank in case I see another opportunity arise. I like to "keep the shotgun loaded," metaphorically speaking, and that's when I would imagine myself seeking a loan.

There is a play I want to make at the end of the month for leagues, and I'm soft-looking for a loan in anticipation of it, but I'm not hungry for it... yet.

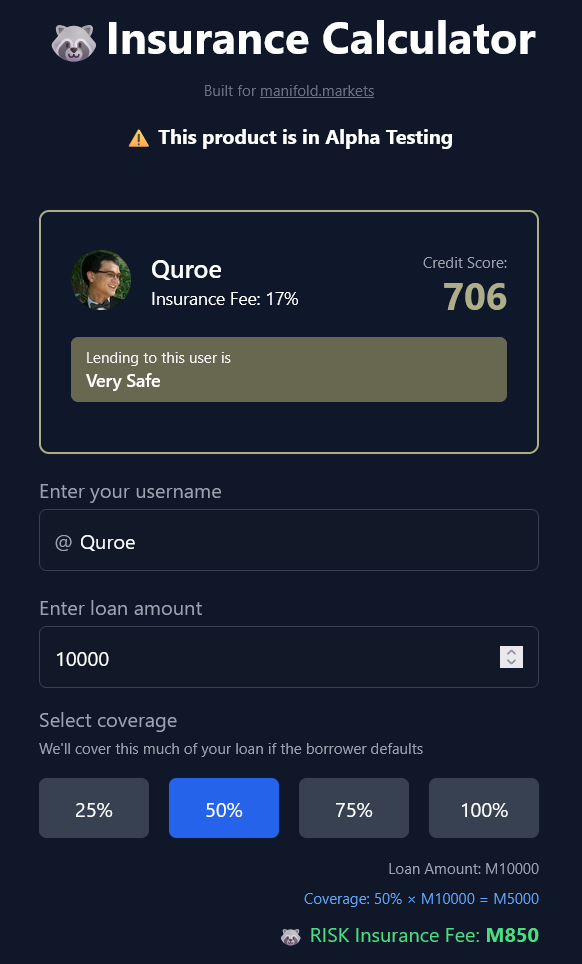

@Quroe 🦝RISK is a new manifold company that I work for and we are developing an algorithm to determine credit scores for manifold users, as well as an insurance fee calculator. I'll attach a screenshot. Now mind you, this product is in the Alpha Testing phase, so the numbers may not line up quite right with your expectations. 🦝RISK is loan insurance. So the borrower pays us the fee and if the borrower defaults, we pay the lender for their coverage option (in the screenshot, we see 50% of the loan is covered by 🦝RISK). This product will release late April/early May...so very soon!

P.S. We use current balance as a strong indicator of credit score. So users with lots of money invested while having little in their balance are considered less safe to loan to and therefore their rates are higher.

@crowlsyong This seems vulnerable to manipulation. For example, suppose that A lends 1000 mana to B, and B lends 1000 mana to A. Both buy insurance, and then both deliberately default.

In the real world, there would be real legal consequences. With mana, you're out of luck.

@TimothyJohnson5c16 We have systems in place to track and penalize fraud. This kind of thing is indeed an issue, but there are solutions. Since all 🦝RISK transactions are logged, we can use user history as a variable in the credit score calculation. In the worst case, fraud may result in blacklisted accounts.

Edit: in addition, fees for low credit users can exceed 100%, so even if they attempt to play the system, they will ultimately loose mana and we will stay solvent.

@Quroe you have a pretty good profit record recently, though I can't help but notice that for the first half of 2024 your profits were oscillating in the low negatives. What was the cause of this, and can I be confident you won't return to that strategy?

@100Anonymous You're right that indeed if I lent 100k mana in one go this would immediately resolve yes, but I think that is very unlikely. From my perspective I would make like max 200 mana by betting yes, while quite possibly losing the 100k mana on a non-repaid loan lol, what would be the incentive to take such a huge risk in one go? I think the most likely case in which this resolves yes is that loads of users consistently borrow and pay back frequent smaller loans, possibly growing to larger loans with earned trust

@4fa yeah you've got great consistent profit growth

Would 100 mana at 4% interest due in a month be ok to start with?

I request as big of a loan as possible for an interest rate of at least 2% a month, interest rate negotiable

@spiderduckpig At LEAST 2% interest you say? How about (your entire net worth)%? /s

It looks like you have very impressive consistent rapid profit in the last few months, though for most of the time before that it was fluctuating in the low negatives.

Could you explain the cause of this huge change in performance? Can I be confident that you won't just as suddenly switch to a strategy similar to what you were doing before or worse?

@crowlsyong hmmm, your long term profit is quite negative, but in the last month things seem to be improving.

Do you know what caused the improvement, and whether we can expect it to continue?

It may be improving because I am watching @Bayesian and @SemioticRivalry and placing small bets similar to theirs.

I can’t say confidently that my trend of positive growth will continue.

I can say confidently that I want to build my manifold credit, so I will always maintain a balance that is capable of paying back a loan from user.

If you want to proof of reputation, wait until April 19 2025. I have a M1000 loan from Bayesian at 1% interest that will be due that day (so M1010 will be repaid). If all goes well, then that user will vouch for my successful repayment on or after April 19 2025.

@crowlsyong Thanks, if it's ok with you then I will wait to verify that this bayesian loan was paid back successfully 👍

@TheAllMemeingEye I have repaid my loan to bayesian on time and in full. I would like to discuss doing business with you if you are comfortable sending me a loan

Requesting: M200 at 5% interest = M210 due May 1 2025

Do we have a deal?

@crowlsyong sounds good 👍 lemme just verify

@Bayesian can you confirm that the loan of 1000 mana was indeed repaid?

Requesting: M200 at 5% interest = M210 due May 1 2025

Your managram message says you want it due May 19 2025. I would like you to clarify which date I am to repay your loan. Either is fine with me.

@crowlsyong ah, my apologies, I should've paid more attention. Let's say the more lenient deadline in the managram message is the one that applies. It's worth noting that you are allowed to pay back a loan early and doing so may allow you to get another loan sooner.