Majority is 50%+ and it's worldwide marketshare

People are also trading

@figo Do you think that will actually happen? I'm not sure, but hopeful.

/equinoxhq/will-lithium-ion-lfp-cell-prices-fa

@NickAllen I made a similar market, but on whether some of the new car sales would be magical unicorns by 2050

Do you mean fully electric (no gas involved), or do hybrids or plug in hybrids count? At the moment, a lot of ev sales are hybrids, although I expect that to change. Might impact people's "the grid won't support it so it can't happen" takes on this question.

Personally, I'm hoping that vehicle to grid functionality means by 2030 BEVs can make their owners money storing variable renewable outputs at off-peak times, and releasing them at peak, and acting as a backup home power source, so that a lot of the grid storage costs that will need to be paid to make wind and solar a very large part of the grid, can be avoided by using batteries we've manufactured for EVs . But that's a hope, not a prediction, as several things I haven't put probabilities on would have to go right.

Relevant other market to arbitrage https://manifold.markets/TobiasSowaaed/will-the-majority-of-new-cars-sold-c4d566afc8c7?r=dGhlc2hvcnRicmVhZA

https://manifold.markets/neweconomicplan/will-50-of-all-new-car-sales-in-the?r=dGhlc2hvcnRicmVhZA

You all really think that the US has smaller chance of being majority electric than the world as a whole?

If it's hard for the US for it to happen I'd say it's almost impossible that it will happen in developing countries which lack much more electric car infrastructure

@theshortbread depends, one thing working against the US is commute length; a lot of people never need their car for more than a few km at a time, which makes it easier to go electric

Analysis in today's "Almost Daily Grant's":

Whither the electric vehicle craze? Data points suggesting that the auto industry’s formerly roaring growth engine is set to shift into neutral are in no short supply: Last week, General Motors withdrew its stated ambition to build 400,000 units by the middle of next year, following Ford Motors’ July decision to delay a 600,000 e.v. annual production pace to late 2024 from the end of this year. On Thursday, Ford likewise postponed a $12 billion spending initiative to increase its e.v. manufacturing capacity.

Faltering demand is driving Detroit’s retrenchment, as Business Insider relayed in late August that inventory “has been piling up on dealership lots,” spurring those vendors to turn away additional units.

Worldwide sales of the category rose by 49% year-over-year during the first half of 2023, market research firm Canalys finds, down from the 63% uptick across calendar 2022, while e.v. market share has held steady at about 9% over the past few months per J.D. Power. Sharply rising interest payments have pinched consumer wallets and driven selling prices lower, with the average battery-powered model going for just under $51,000 last month according to Cox Automotive, a 22% downshift from September 2022. That compares to $47,799 for all other vehicles, down some 2% year-over-year.

Elevated replacement costs for e.v. components and a dearth of specialized technicians to troubleshoot mechanical problems further dilute the value proposition for potential customers: average insurance costs rose 72% over the first nine months of the year, data from comparison site Confused.com show, well above the 29% uptick for combustion autos.

“As we get further into the transformation to e.v.’s, it’s a bit bumpy” GM CEO Mary Barra commented a week ago, while Mercedes-Benz CFO Harald Wilhelm expressed the state of play thus: “This is a pretty brutal space. I can hardly imagine that the current status quo is fully sustainable for everybody.”

Investors, too, are contending with a painful course correction, as the e.v. boom’s avatar encounters rough terrain. Tesla, Inc. (ticker: TSLA) revealed on Oct. 18 that adjusted third quarter earnings per share and revenues summed to $0.66 and $23.35 billion, respectively, well shy of the $0.73 and $24.12 billion analyst consensus.

A stark decline in profitability accompanied the firm’s first such “double miss” since mid-2019, as operating margins shriveled to 7.6% from 17.2% a year earlier. TSLA has absorbed a 24% pullback since Grant’s Interest Rate Observer reached a bearish conclusion on Sept. 30, 2022, compared to an 19% return for the S&P 500 and 32% advance for the Nasdaq 100 (see “Elon in the mirror” in the July 14 issue for a follow-up analysis).

“At the crux of the problem is a capital-intensive sector investing in unproven e.v. strategies amid a world of rising costs, rising rates and slower demand,” writes Morgan Stanley analyst Adam Jonas, who nonetheless assigns a $380 target price to Tesla shares, some 57% north of the Street consensus and nearly double the current level. Wall Street collectively expects earnings per share of $4.07 during full-year 2024, compared to $6.69 as of Dec. 31.

Downbeat recent assessments from a pair of key Tesla suppliers, meanwhile, could suggest more such haircuts to come. Panasonic Holdings Corp. disclosed Monday that it cut back on third quarter battery cell production in Japan by 60% on a sequential basis due to soft demand, with no return to full capacity in the cards “any time soon” per Panasonic CFO Hirokazu Umeda.

Also yesterday, chipmaker ON Semiconductor guided fourth quarter earnings per share and revenues of $1.20 and $2 billion respectively, using the midpoint of management ranges, shy of the $1.36 and $2.18 billion analyst expectations. “A single outlier of a customer” helped drive that lackluster outlook, ON CEO Hassane El-Khoury revealed on Bloomberg Television, pointing to “an automotive original equipment maker in North America” but adding that he “would rather not get into customer specifics.” Tesla is “strongly” suspected to be the culprit, Truist analyst William Stein subsequently wrote.

For his part, Mr. Market continues to put Elon Musk’s corporate pride-and-joy on a pedestal, valuing TSLA shares at 50 times next year’s EPS estimate, compared to 5.6 times forward earnings for Ford and 4.3 times for General Motors. Referencing that fancy multiple in the face of deteriorating earnings estimates and lack of operating momentum, Bernstein analysts marveled yesterday that “to some extent, the real bull case is that none of this matters [due to the fanatical retail investor base].”

“People are finally seeing reality,” Toyota Motors chairman Akio Toyoda declared to The Wall Street Journal last Wednesday, referencing declining growth expectations for electric vehicles at large. Some people are, anyway.

With the advent of new technologies such as AI, machine learning, and ChatGPT, it is clear that physical manpower is being replaced by automation. Additionally, companies are moving towards net-zero emissions, making it clear that carbon-emitting non-electric vehicles are not welcome, Tesla has already built a car that drives itself, and it is believed that by 2030, all cars will be electric, with non-electric vehicles encouraged to be swapped.

Why electric cars will take over sooner than you think - BBC News

@KashalaOrnella lol that article (from the British Broadcasting Caliphate, no less) suggests 40% (according to UBS) by 2030. Who are you people that leave GPT-like comments on here these days?

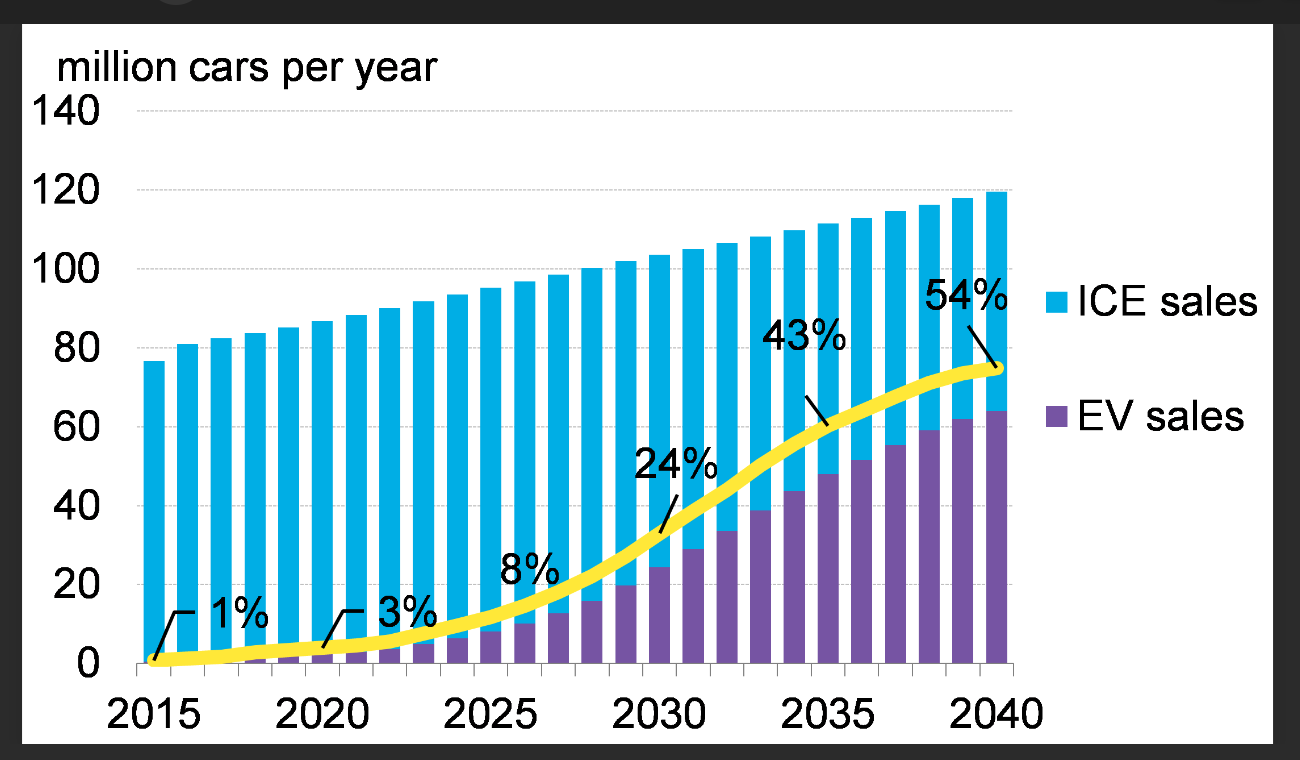

In the "net-zero emissions scenario by 2050" (NZE scenario), sales of new internal combustion engine (ICE) vehicles would stop in 2035. At the same time, the share of electric vehicles in total sales needs to reach about 60% by 2030 to stay the course and achieve net zero CO2 emissions by 2050. By the end of 2021, the number of electric vehicles on the road will exceed 16.5 million. Global electric vehicle ownership is set to rise to nearly 350 million by 2030, but future growth will depend on efforts to diversify battery manufacturing and supply of key minerals to reduce the risk of supply bottlenecks and price increases.

According to the rocky mountain institute, Electric cars are meant to surpass two-thirds of global car sales by 2023 which also puts a risk on the oil demand are people will be moving towards battery recharge(RMI, n.d.). Other news state that electric cars will be 62% to 86% of global sales by 2030 (Walz,2023). There are over 10 million electronic vehicles sold worldwide which according to secondary research surpass the total number of cars sold across the entire european union. At the end of 2023, the EV sales are expected to be 14 million representing a 35% year-on-year increase with new purchases increasing in the second half.

References

RMI. (n.d.). EVs to Surpass Two-Thirds of Global Car Sales by 2030, Putting at Risk Nearly Half of Oil Demand, New Research Finds. Retrieved from https://rmi.org/press-release/evs-to-surpass-two-thirds-of-global-car-sales-by-2030-putting-at-risk-nearly-half-of-oil-demand-new-research-finds

https://www.automotivedive.com/news/evs-reach-86-percent-global-vehicle-sales-2030/695319/

https://www.iea.org/reports/global-ev-outlook-2023/trends-in-electric-light-duty-vehicles

https://www.iea.org/reports/global-ev-outlook-2023/executive-summary

By the end of 2030, it is likely that electric vehicles (EVs) will account for the majority of newly sold automobiles. This forecast is supported by several variables.

To encourage the adoption of electric vehicles, governments all over the world are enacting strict pollution restrictions and offering incentives. Large automakers are increasing production, diversifying their EV lineups, and investing more in EV technology in order to keep up with demand.

With the quick advancement of battery technology, EVs are becoming more accessible and useful for customers. With longer battery life, more widespread charging infrastructure, and faster charging periods, range anxiety is decreasing.

Transportation that is greener and more sustainable is becoming more and more popular. With their reduced environmental impact, simplicity of home charging, lower running costs, and better driving experience, electric vehicles (EVs) are becoming more and more popular as environmental consciousness grows. Furthermore, as more nations and cities announce bans or phase-outs of internal combustion engine use, the shift to electric mobility is accelerated by global pledges to tackle climate change.

Despite obstacles, these patterns indicate a future where the majority of new automobiles sold by 2030 will be electric vehicles, creating a more environmentally friendly and sustainable transportation scenario.

The electric vehicle (EV) market has witnessed a significant surge, with its share growing from 4% in 2020 to 14% in 2022, and sales in the first half of 2023 outpacing the previous year. Predictions suggest 14 million EV sales by year-end, constituting 18% of 2023's total car sales. Driven by both environmental and financial benefits, consumers are increasingly choosing EVs. Global policies encourage EV adoption through tax incentives and charging infrastructure expansion. With a $210 billion investment planned in U.S. EV manufacturing, there's a strong belief that EVs will surpass internal combustion engine vehicles by 2030.

I vote yes because the electric vehicle (EV) market is experiencing a remarkable upswing, supported by a series of compelling factors. The most notable of these is the rapid growth in EV market share, which surged from 4% in 2020 to a substantial 14% in 2022. This trend has shown resilience into 2023, with sales for the first half of the year surpassing the same period in the previous year. Projections indicate that over 14 million electric vehicles could be sold by the end of 2023, constituting 18% of total car sales for the year.

The shift towards electric vehicles is not solely driven by environmental concerns but is also financially motivated. Consumers are drawn to EVs due to significant cost savings on fuel and maintenance. Governments across the globe are actively supporting this transition by implementing policies such as tax incentives for EV buyers and expanding charging infrastructure.

A substantial $210 billion investment is earmarked for electric car manufacturing in the United States, underlining the industry's growing significance. With these compelling developments, the electric vehicle market appears poised to eclipse the internal combustion engine (ICE) car market by 2030, reflecting a pivotal shift in the automotive landscape.

@MinaBrown NO

Disagreeing with the concept that the electric vehicle (EV) market will be the majority of new cars sold by the end, especially in light of the substantial statistical data backing its rise. While the worldwide EV industry is expected to hit 10 million units in 2022, accounting for 14% of all new car sales, this increase is coming from a relatively low base when compared to the overall automotive market. https://www.fortunebusinessinsights.com/industry-reports/electric-vehicle-market-101678

In the United States, for example, EV sales increased from 0.2% of total car sales in 2011 to 4.6% in 2021. While this growth is impressive, it shows that EVs still account for a small portion of total car sales. Furthermore, the success of EVs is strongly dependent on factors such as battery technological breakthroughs, the growth of charging infrastructure, and long-term government subsidies, all of which face several hurdles and uncertainties. https://www.bls.gov/opub/btn/volume-12/charging-into-the-future-the-transition-to-electric-vehicles.htm#:~:text=Ready%20to%20charge%20into%20the,1

Thus, while the EV market is growing higher each year, the claim that it would surpass the regular car market by 2030 may be unduly optimistic. Although progress is being made, the shift to electric vehicles may take longer than expected due to the scope and complexity of the automobile industry's revolution.