FED pivot is defined as the change in the approach of defining the upper bound of the target federal funds range, so-called 'interest rates'. The decisions on the target federal fund range are made by the Federal Open Market Committee (FOMC) meetings.

This market will resolve to the month on which the Federal Open Market Committee decides to decrease interest rates (over the level it was prior to the meeting).

ONLY ANSWERS WITH FORMAT "Month YYYY" like "August 2023" will count for the resolution!

For the time on or after January 2030, "Not before 2030" answer will be considered.

The level and change of the target federal funds rate is published at the official website of the Federal Reserve at https://www.federalreserve.gov/monetarypolicy/openmarket.htm.

@RanaG Because this is a "Parimutuel" market. It is an old type of market that has since been discontinued. The main problem with it is that future traders can influence the payouts of shares people hold right now. Assuming that your bet on May-2024 is correct, and that the market is bet up to 99% after the announcement, then the shares you bought at 30-40% may end up paying out as if you bought them at 90ish%, instead of ~tippling your initial investment.

https://news.manifold.markets/p/above-the-fold-market-mechanics (search for "one huge downside" to skip to the relevant bit.)

I assume that since Parimutuel markets are deprecated, they never implemented or stopped maintaining charts for them.

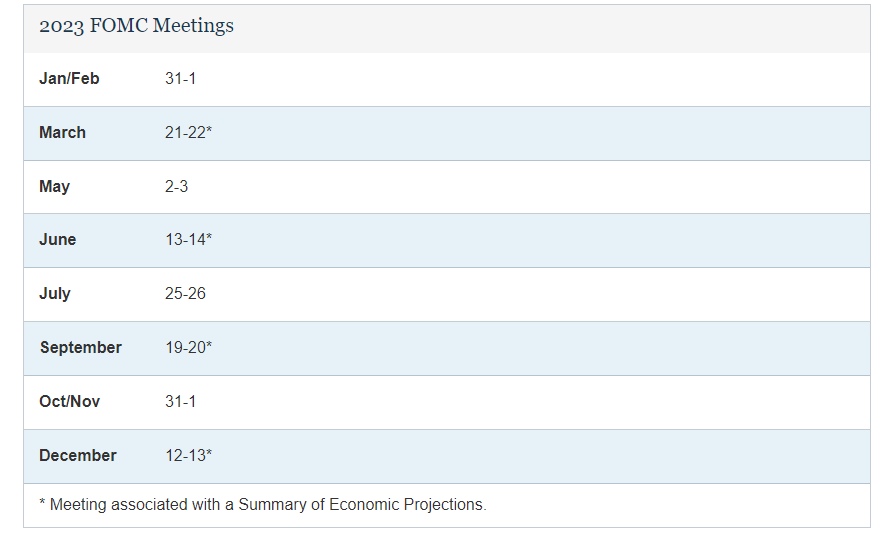

@TrickyDuck No problem, here's the schedule. The last unscheduled meetings were in March 2020, slashing rates to zero due to Covid.

@Quroe yeah this market is quite broken from converting from old MC. But by using limits you can keep the bars somewhat under control.

@RanaG Because this is a "Parimutuel" market. It is an old type of market that has since been discontinued. The main problem with it is that future traders can influence the payouts of shares people hold right now. Assuming that your bet on May-2024 is correct, and that the market is bet up to 99% after the announcement, then the shares you bought at 30-40% may end up paying out as if you bought them at 90ish%, instead of ~tippling your initial investment.

https://news.manifold.markets/p/above-the-fold-market-mechanics (search for "one huge downside" to skip to the relevant bit.)

I assume that since Parimutuel markets are deprecated, they never implemented or stopped maintaining charts for them.

@UnconditionalProbability For that reason, it is important for parimuturel markets to CLOSE trading before the event happens. So interested traders on this market should ping a moderator the day of/before an expected announcement. If there is no announcement then trading can resume afterward.

Looks like March 21-22 is the next meeting so we would want to close trading then and reopen if it didn't happen to resolve this Yes.